Choose the right payment provider for your app, understand how Stripe works from sandbox to verification, and know when an LLC and an EIN are needed. Learn the trade-offs between global reach and LATAM-focused solutions while keeping setup practical and lean.

What payment options fit your app and region?

Choosing a provider depends on scope and availability. Stripe is a global payments infrastructure used by major companies. If opening or using Stripe is hard in Latin America, consider MercadoPago (solid API and docs) or Rebill for LATAM support. Decide if you want a LATAM-specific market or a US/Europe/global market.

- Stripe: global reach and robust tools.

- MercadoPago: strong API and documentation.

- Rebill: LATAM-focused with Stripe-like features.

- Scope matters: local focus vs broader markets.

How does stripe setup and sandbox mode work?

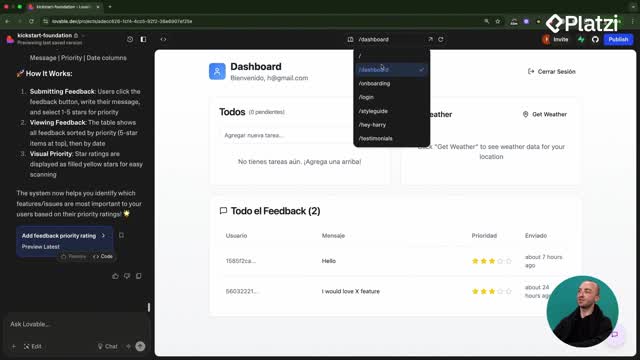

After you create a Stripe account, you see the dashboard and remain in sandbox mode until you verify your business. You’ll need a bank account that Stripe accepts. Add that bank account, verify, and then connect it to Stripe for live payments.

- Account created: view the Stripe dashboard.

- Sandbox mode: testing until verification.

- Verification: provide business details and bank account.

- Bank account: must be one that Stripe accepts.

- Connection: link the verified account to Stripe.

What is an LLC and how to open one for Stripe?

An LLC is a company formed in the United States for about $50–$100. You receive an EIN. With that EIN, you can open a US bank account under your business name and connect it to Stripe. Services like LegalZoom let you do the paperwork and pay only the state filing fee (around $50–$100), keeping costs predictable.

- Form an LLC online and get an EIN.

- Use the EIN to open a US bank account.

- Connect the business bank account to Stripe.

- LegalZoom example: pay the state filing fee.

Which market are you targeting and why does it matter?

Your target market shapes the stack. For US/Europe/global, Stripe simplifies scaling. For LATAM, MercadoPago or Rebill can be more accessible while offering similar core features.

What comes next inside Stripe?

You’ll set up products and prices in Stripe to complete the payment infrastructure before going live.

Have a question about Stripe vs MercadoPago or how LLC and EIN fit your plan? Share it in the comments.