What is difference between IPO and Acquisition?

You are playing a 7-10 years game.

Investors want their money back multiplied by 30x-40x.

In Theory you have 2 paths:

What is the best?

IPO - if you have a vision that your company can get investors

Is very hard to go public in Latin America. In colombia, you have only 30-40 companies listed. If you want to go public, you will have to go public in the USA. For this you have to be massive.

Therefore in emerging markets, most of the startups decide to go the other way and get acquired.

Acquisition - find a buyer - often a bigger company.

Tips: don’t be concerned about this at an early stage.

How to calculate LTV when your business model is commission based?

Now:

LTV is : 5 USD x 3 hours x 5 days x 6 months =

sometimes in early stage you dont have all those variables with a lot of certitude as you miss track record. As founder you can then do an estimate of what should be your LTV looking at data from the markets (industry report, benchmarks with competitors,)

At this stage what you need to prove is not that you data are 100% backed by your numbers but that your raisonning is accurate and logical.

Para la ronda semilla es en tiempo o dinero que se debe buscar?

90% of more of founders don’t know anything about finance. The reason for that is that founders are concern at first about Product and building something people want.

So the first good habit you need to create is to register any transaction you are doing.

One by one don’t leave that for the end of the week or month do it straightaway. Don’t get concern about having the best financial software. You can start with an excel once you get the right dynamic and see it’s taking you too much time, start to look for a financial software.

Once you have some money I will recommend you to hire an account.

Raising Seed Round

Once you start raising money with investors as a startup, you will have to keep going that way as investors want their money back with a multiplier.

Every time i can use someone else money that doesn’t cost me anything, this is great for your personal security. But you have to consider they will expect you behave as a proper founder:

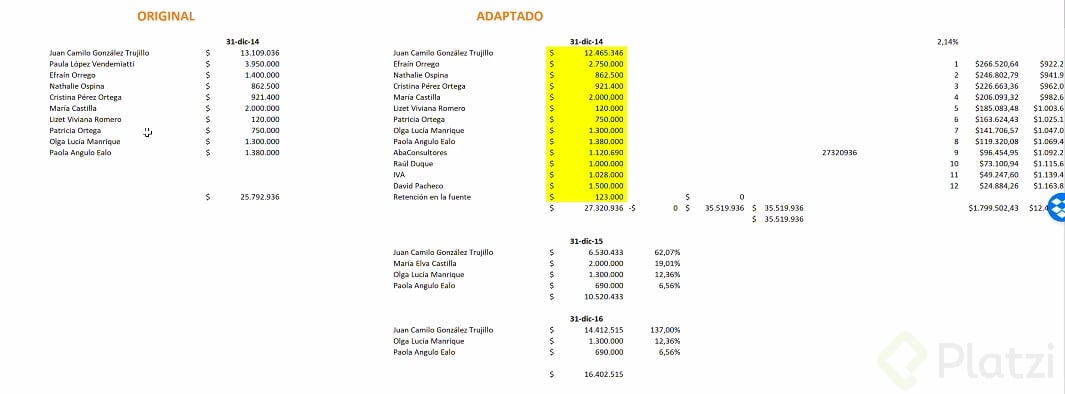

Cash Flow Forecast template:

If you don’t have any income you need to make sure you have enough investment cash to survive.

“being super optimist or super pessimist both scenario are nocif for your startups”

How to handle losing money with your investors

I would not say losing money, I would say spending money. As long as your expense have full connection with your startup business and idea you should not be afraid to share the real situation with your investor and be transparent.

It’s likely normal to feel ashamed to show you have burn all the cash but good investors should understand the startup game and in some occasion they will even be ready to invest some more money so you can keep growing.

Metrics to track in early stage

if you give free advice to your customers. Do you count that as part of your CAC?

“I am giving a free financial diagnostic” instead “I am giving a free financial advice”

Not part of my CAC as it is part of my product. CAC should be only advertising and any action I am paying to acquire customers. So I would use the argument that the free diagnostics is part of my product and this is why I am not considering it as part of my CAC.

Select the right metrics (instead of vanity metrics) - right metrics show that growing this metrics has an effect on growing the money of the company or growing the direct impact on the vision of the company.

Have a logical explanation for choosing those metrics and when presenting those metrics.

Objective:

“how you show someone you have something that can grow fast in your hands ?”

—

Some tips:

“Don’t believe that anyone that has money is a good investor for you! You can also reject investors!”

Ask intro to investors from other founders so you have kind of a social investor quality validation

Every Monday Morning from 08:30 to 09:30 Col/Mex/Peru time we host a session gathering early-stage and see startups founders and leader to get good energy to start the week. We always have a guest which is an experience Startup founder or Top Employee, or an investor joining the session for a Q&A session.

If you are interested to take part to those session, reach out to [email protected] with your full name, startup name, 2 sentence description about your startup and url to your webpage.

Hi Juliane!.. Are this sessions still active?